With crypto derivatives and futures, crypto investors can earn high returns over a very short period of time. Likewise, trading in crypto derivatives and crypto futures for the purpose of hedging spot trading (traditional buying and selling of cryptocurrencies) is very popular. Platforms such as Binance, BitMEX, Kraken and eToro now offer a variety of crypto derivatives and futures at a wide range of conditions. For the tax assessment, the name chosen by the crypto exchange is not the decisive factor but rather the type of financial product behind it is, which is why it is often necessary to consider each individual case in detail. Because the offset losses have changed from 2021, caution is necessary now!

What are derivatives and futures?

Derivatives and futures are often mentioned in the same breath, but futures are merely a special subcategory of derivatives. Derivatives are a generic term for a number of various financial instruments that can be structured in different ways. Although there is no conclusive definition of derivatives, they are, in a sense, a contract in which at least one vendor grants at least one buyer the right to receive a specific asset at a specific time. The subscription right may be conditional or unconditional. This means that the buyer may be given the option to purchase the asset or, however additionally, be obliged to accept it. In the latter case, the contract is a futures contract. In addition to the time interval between the conclusion and performance of the contract, derivatives are characterized by the fact that the price of the derivative is dependent on an underlying asset. In other words: The price of the derivative is largely determined by the underlying asset. For example, if a buyer has acquired the right to purchase one bitcoin (BTC) at a price of 35,000 euros, i.e. has acquired a BTC derivative with no obligation to purchase, then the value of the derivative will increase as the BTC price increases.

What type of taxes accrue on crypto derivatives and crypto futures trading in Germany?

At the end of the year at the latest, crypto investors have to ask themselves how the profits or losses they have made should be classified for tax purposes in Germany. Profits and losses on crypto derivatives and crypto futures are generally subject to capital gains tax. This is very encouraging for crypto investors because: Instead of the personal income tax rate, which can be up to 45 percent, depending on income, capital gains tax accrues only at a flat rate of 25 percent. This requires a classification of crypto derivatives and futures as forward transactions within the meaning of § 20 Para. 2 clause 1 no. 3 of the German Income Tax Act (Einkommensteuergesetz, EStG). Essentially, the question is whether the business, such as with spot trading, is focused on the delivery of a cryptocurrency or whether the delivery of the cryptocurrency is merely the settlement of the difference. The profits are only taxed in the latter scenario in accordance with the capital gains tax.

A simplified example serves as an illustration:

Person A concludes a contract with Person B that entitles A to the right to a future purchase of a BTC from B which currently has a value of 35,000 euros. At the maturity of the contract, A receives the BTC from B. In this case, § 23 Para. 1 clause 1 no. 2 of the German Income Tax Act (private sale transaction) applies. For B, this means that they must pay tax on the sale of the BTC with their personal income tax rate. On the other hand, this is an acquisition for A, and, with this, the one-year holding period begins.

However, if, in the case described above, A and B agree that A has the option at the end of the contract as to whether they receive one bitcoin or, alternatively, the equivalent of the difference to the current rate, then this is a forward transaction pursuant to § 20 Para. 2 clause 1 no. 3 of the German Income Tax Act. This is true even in cases in which the difference is paid in BTC. For example, if the price of the BTC increases to 37,000 euros at the end of the contract, A receives the equivalent value of the difference (37,000 euros – 35,000 euros = 2,000 euros) in BTC. Due to the capital gains tax, A must then be taxed for the profit in the amount of 2,000 euros at a flat rate of 25 percent. According to § 23 of the German Income Tax Act, the holding period does not apply to A. If necessary, a private sale transaction in accordance with § 23 Para. 1 clause 1 no. 2 of the German Income Tax Act may be available for B.

In individual cases, the differentiation can be quite complicated. In the event of doubt, crypto investors can, however, provide security through the aid of the tax tools from ACCOINTING in an uncomplicated process. If the executed trades involve crypto derivatives and futures, the tool carries out a correct tax valuation automatically and in a legally secure manner.

Limited offset losses bring tax disadvantages

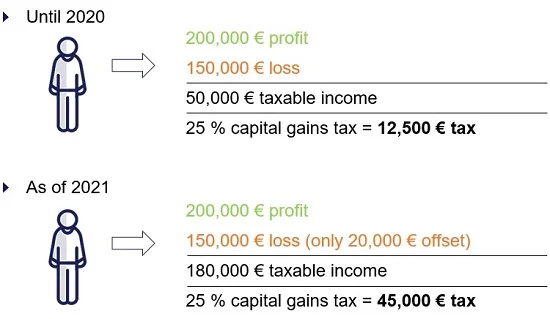

Since the legislative change of January 01, 2021, losses from trading with crypto derivatives and futures can no longer be offset without restriction. On one hand, it is now only possible to offset losses against gains from forward transactions or returns from option sales transactions (a certain type of option transaction). Furthermore, losses can only be offset up to an amount of 20,000 euros per year. This leads de facto to a minimum taxation:

As the example shows, the new loss account entails far-reaching negative consequences for private investors. De facto, due to the enormous tax burden, trading crypto derivatives and futures is hardly feasible for private crypto investors.

Trading company as alternative

The foundation of a trading limited liability company (GmbH) is the solution. Through this, losses from derivatives and futures can be offset without restrictions – a considerable tax advantage! Due to the fact that a limited liability company always generates commercial income, the limitation of the loss account from § 20 Para. 6, clause 5 of the German Income Tax Act is not applicable, which is why profits and losses can be offset in full. Additionally, if one would like to offset any remaining losses against other income, this is therefore likewise an option.

The requirement for this is that the trading company is structured as a financial company. At the same time, such a structure ensures that the company is not under the supervision of the German Federal Financial Supervisory Authority (BaFin). However, careful examination is necessary here, as the threshold for activities subject to authorization can quickly be exceeded. It is, likewise, advisable to coordinate the classification as a financial company together with BaFin and to request a “no action letter”. Herein, BaFin confirms that there is no supervisory obligation for the project.

Furthermore, it makes sense to coordinate with the tax office as well by obtaining binding information. The tax office thus confirms that limited offset losses do not apply to the trading limited liability company.

WINHELLER gladly supports you

Would you like to utilize the tax advantages of a trading limited liability company? Do you have questions about the taxation of crypto derivatives and futures? Please do not hesitate and contact us! Our experienced attorneys and tax advisors are at your disposal!

Continue reading:

Crypto Tax Return in Germany: Deadlines, Penalties, Consulting

Crypto Profits in Germany: What to Do in Case of Official Investigations And Criminal Proceedings?