The calls of many small and medium-sized entrepreneurs in Germany have been heard. After the failed first attempt in 2000, it will be possible for shareholders of a general partnership (OHG) or a limited partnership (KG) to choose between income tax treatment as a partnership or as a corporation as of 2022. The corresponding law was passed by the German Bundestag on May 21, 2021.

The calls of many small and medium-sized entrepreneurs in Germany have been heard. After the failed first attempt in 2000, it will be possible for shareholders of a general partnership (OHG) or a limited partnership (KG) to choose between income tax treatment as a partnership or as a corporation as of 2022. The corresponding law was passed by the German Bundestag on May 21, 2021.

What are the advantages of being taxed as a corporation?

Those who choose to be taxed as a corporation can benefit from a variety of significant tax advantages, including, for example:

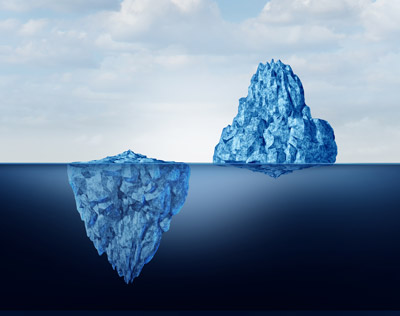

- At 30.825 percent, the effective tax burden of corporations is generally lower than that of partners in a medium-sized partnership at just under 50 percent (plus any income tax). Of course, one should not forget at this point that the profit distributions of a corporation to its shareholders are still taxable at an effective rate of approximately 26.25 percent (+ any church tax). Accordingly, the advantage here clearly lies in the tax-favorable accumulation and investment opportunities for corporations. Partners in a partnership do not have nearly as effective accumulation options available to them.

- In addition to this accumulation advantage, corporations can also build up a company pension plan for the shareholders.

- Activity payments to shareholders are deductible as business expenses at the level of the company (however, they constitute as wages for the shareholder).

What are the disadvantages of switching to taxation as a corporation?

The corporate income tax option, however, does not only bring advantages, e.g.:

- The tax treatment of the transfer or contribution of assets in a corporation is significantly more complex than in a partnership.

- A balance sheet is mandatory. A simple “income surplus statement” is no longer sufficient.

- The switch to corporate income tax leads to subsequent taxation if the accumulation benefit was claimed in previous years.

- Articles of association as well as a multitude of other contracts shall be concluded.

Can property still be transferred to the partnership without incurring real estate transfer tax?

After a change to taxation as a corporation, property can no longer be transferred to the partnership without incurring real estate transfer tax. Due to the risk of abuse, the federal government passed the law with a corresponding amendment to the original initiative. Tax-free real estate transfers of property to the partnership will only be possible again ten years after the switch to corporate income tax, and only if the partner has held the partnership shares for more than ten years.

Furthermore, the exercise of the option has adverse effects for property that has been transferred to the partnership free of real estate transfer tax within the last five years or for transfers within ten years as of 01.07.2021.

Does the option have any effect on asset succession?

Since the choice to be taxed as a corporation applies only to income taxes, there is no change at the inheritance tax level. Thus, a minimum shareholding ratio is still not required for a partnership to be able to benefit from the tax exemption for business assets according to §§ 13a, 13b of the German Inheritance and Gift Tax Act (Erbschaftsteuergesetz, ErbStG).

Does the choice affect my liability or the company?

The choice of taxation also has no impact on corporate and civil law. The liability of the partners of a partnership remains unchanged. Furthermore, a transfer of shares in the partnership still does not have to be notarized.

Admittedly, the change requires some amendments to the articles of association, in particular an adjustment of the deposit regulations and the distribution of profits.

What is the procedure for choosing to be taxed as a corporation?

The choice must be made one month before the end of the fiscal year by submitting an application to the tax authorities. This request is irrevocable, so it should be given careful consideration. Exercising the option has the same tax effect as a change of legal form. This process brings with it a number of tax structuring and valuation opportunities. However, only the contribution of the entire partnership shares for tax purposes, i.e. the shares of the functionally significant special business assets as well, is essentially possible in a tax-neutral manner. This in turn requires additional agreements as there is no change of legal form under civil law. In addition, a change of legal form can prompt retention periods for the sale of the partnership share.

Can I be taxed as a partnership again?

A return option – i.e. taxation as a partnership again – is provided for by statute. Similarly, it can be handled as a change of legal form for tax purposes. The return option decision must be made before the start of the fiscal year. A change during the fiscal year is therefore not possible.

Advice on the taxation of German corporations

Since the option to be taxed as a corporation has a host of advantages and disadvantages and can be extremely demanding in terms of tax law, the switch should be carefully considered and well planned. It is highly recommended that you discuss the option in detail with your trusted advisor. Our experienced attorneys and tax advisors will be happy to assist you.

Continue reading:

Financial Challenges of Business Successions

How Much Capital Is Required to Set Up A German Family Foundation?